How To Use Alpha Vantage Api

Last Updated on January 11, 2021

Tabular array of Contents

- What is the Alpha Vantage API?

- Is the Alpha Vantage API complimentary?

- What kind of data does the Alpha Vantage API offering?

- What are the advantages of using the Alpha Vantage API?

- Why shouldn't I use the Alpha Vantage API?

- What are some alternatives to the Alpha Vantage API?

- How do I get started with the Alpha Vantage API?

- Do I demand to utilise a library to admission the Alpha Vantage API?

- How practise I configure the Blastoff Vantage Library?

- How practise I retrieve stock data using the Alpha Vantage library in Python?

- How tin I go call back stock data without using the Alpha Vantage library in Python?

- Does the Alpha Vantage API piece of work well with the Pandas Library?

- Should I use the CSV or JSON format for my data?

- How can I use technical indicators with the Blastoff Vantage library?

- Final Thoughts on the Alpha Vantage API

What is the Alpha Vantage API?

The Alpha Vantage API is a method to obtain historical and realtime data for several markets.

You lot can access the data direct in Python or any other programming language of your choosing. From there, yous tin manipulate the data or store it for subsequently use.

Is the Alpha Vantage API free?

Blastoff Vantage proudly offers its service for free. They provide a generous charge per unit limit of 5 requests per minute and 500 requests per twenty-four hours.

Several premium plans are available if y'all crave a higher rate limit. The premium plans beginning at $29.99 per month for 30 requests per infinitesimal and become as high every bit $249.99 per month for 1200 requests per minute.

Premium plans come up with 24/7 technical back up and don't have daily limits.

What kind of data does the Alpha Vantage API offer?

Blastoff Vantage offers historical and realtime data for stocks, forex, and cryptocurrencies. Several time frames are available ranging from i-minute bars up to monthly.

In addition to toll data, in that location are more than fifty technical indicators bachelor likewise as functioning data for 10 United states of america disinterestedness sectors.

What are the advantages of using the Blastoff Vantage API?

The biggest advantage is that its free. Farther, the data is extensive. We institute toll data dating back 20 years for stocks and forex. Cryptocurrency data for assets like Bitcoin went back every bit far as 2011 in terms of daily price data.

» Quandl Guide: Learn how to retrieve toll and non-price data from Quandl.

Examples

- WTI Crude Oil prices

- U.s. GDP Data

- Facebook Annual Report Data

Link: Quandl: A Step-by-Pace Guide

Why shouldn't I use the Alpha Vantage API?

Y'all may not want to use the Alpha Vantage API if you already have access to price information through your broker. Information tin differ from ane provider to another and its best to use banker data if you plan to execute trades.

Along the aforementioned lines, some automatic systems are very sensitive to small differences in data betwixt different providers. In this scenario, information technology's worthwhile comparing data with other providers. Paid data providers ofttimes boast that they have the near accurate information available.

What are some alternatives to the Alpha Vantage API?

There were a number of complimentary information APIs a few years ago such equally Google Finance and Yahoo Finance. Unfortunately, they no longer offer an official API.

The Investors Exchange (IEX) is one of the few providers that nonetheless offers gratis API access. Their offer is a scrap more extensive compared to Alpha Vantage. However, their rate limits can be a footling tricky as each endpoint carries a dissimilar weight in terms of how many requests you can make.

» IEX offers earnings information, news, financial statements in addition to historical information. Check out our IEX API guide: IEX API Introduction Guide

Some other culling is worldtradingdata.com who offers free access to their trading API for up to 250 requests per solar day. Premium plans are available starting at $8 per calendar month and become as high as $32 per calendar month.

How exercise I get started with the Blastoff Vantage API?

The first step is to merits your API key. The process is quick and easy and a key is necessary for all the requests.

After getting your cardinal, we highly recommend having a look at the API documentation. Yous can encounter what kind of information is beingness offered, simply more importantly, this is where y'all can figure out which parameters are required for each API request. You will probable exist referring to it a lot.

The next pace is deciding if you lot desire to utilize the Alpha Vantage library.

Practice I need to employ a library to access the Blastoff Vantage API?

This is certainly a case where you lot can get away without using the library, although it does brand things a bit easier.

Aside from standard API functionality, the library offers panda's integration and simplifies the process of plotting charts.

You lot can install the library past running pip install alpha_vantage from the control prompt. If yous don't accept pandas installed on your arrangement, you can use pip install alpha_vantage pandas.

Alternatively, download the zip file from the GitHub repository and extract the alpha_vantage binder in your projects folder.

If you lot've gone through our Alpaca API guide <INSERT LINK> yous will already accept the Alpha Vantage python library on your arrangement.

How do I configure the Alpha Vantage Library?

Later on installing the Alpha Vantage library, it is a good idea to shop your API fundamental as an environs variable. This is an extra security precaution so that your primal is not visible in obviously text within your code.

There have been instances where individuals have pushed code to their public GitHub page only to have someone exploit their key, so this step is highly recommended.

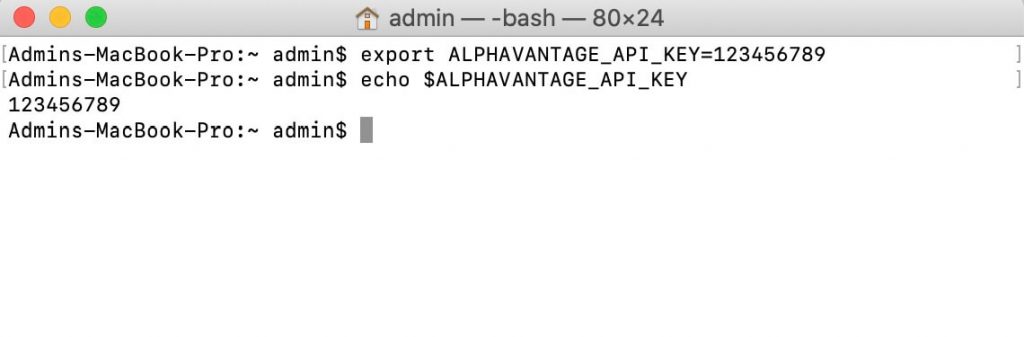

Saving your key as an environment variable

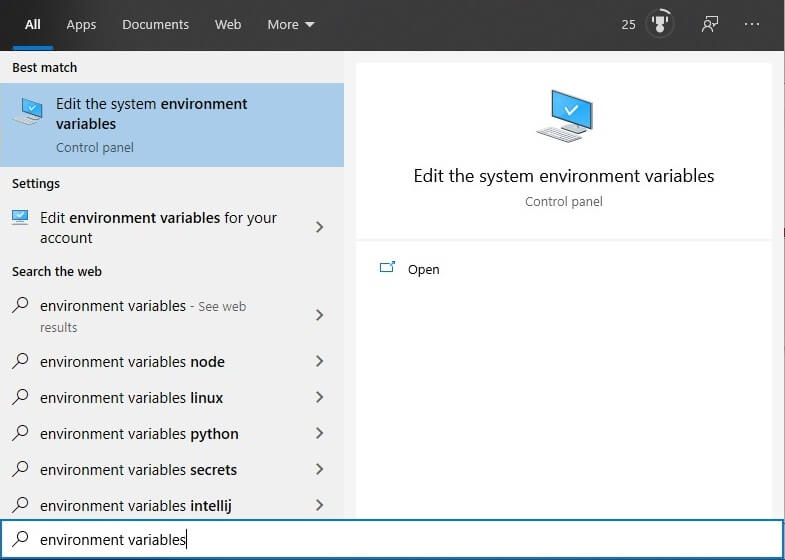

Windows – Click First and blazon in environment variables. You should run across an choice to Edit environment variables for your account.

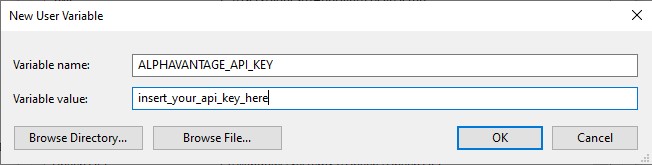

In the new window that pops upwards, click New nether the User variables section.

Your variable name should exist ALPHAVANTAGE_API_KEY and the variable value is where you can paste in your key.

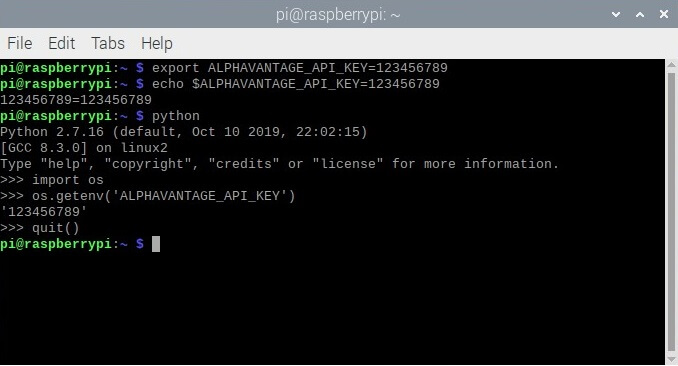

Mac/Linux – From your terminal, type in:

export ALPHAVANTAGE_API_KEY=123456789

Brand sure to utilise your actual API key for the value. You can ostend that the environment variable is saved by typing in the following which should display your API key:

repeat $ALPHAVANTAGE_API_KEY

If the environment variable comes upwards blank in Python you made need to restart your code editor for the changes to accept effect.

Importing the library into Python

After setting the surround variable, yous'll want to import the Alpha Vantage library into Python.

The library is set up in such a manner that each of the five sections within the Alpha Vantage API documentation has been coded in a separate file within the library.

You lot will have to import the appropriate part of the library and instantiate the grade within it. Here is an example.

from alpha_vantage.timeseries import TimeSeries app = TimeSeries()

In the above code, we import the TimeSeries form from timeseries.py which is the part of the library that handles API calls for stock data. We and so instantiate the TimeSeries class to inherit all of its functions.

If you lot didn't shop your API key in an environment variable, you tin can laissez passer it through when instantiating the course similar this:

app = TimeSeries('your_api_key_goes_here') Otherwise, the library will automatically grab the API key from the environment variable for you.

To make things easier, we've created a table that links the required import argument corresponding to each section of the Alpha Vantage documentation.

| Blastoff Vantage | Import statement for library |

|---|---|

| Stock Time Series | from alpha_vantage.timeseries import TimeSeries |

| Forex (FX) | from alpha_vantage.foreignexchange import ForeignExchange |

| Cryptocurrencies | from alpha_vantage.cryptocurrencies import CryptoCurrencies |

| Technical Indicators | from alpha_vantage.techindicators import TechIndicators |

| Sector Performances | from alpha_vantage.sectorperformance import SectorPerformances |

How do I retrieve stock data using the Alpha Vantage library in Python?

At this indicate, nosotros've imported the library and instantiated the TimeSeries class. Our next step is to grab some information.

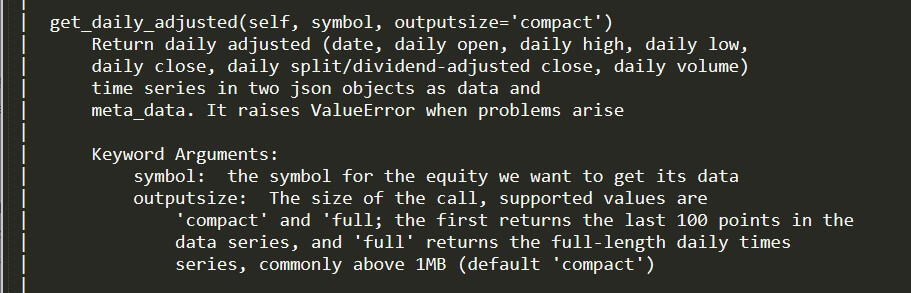

In that location are several options available nether the Stock Time Series section of the Alpha Vantage documentation. We will get with Daily Adapted data, otherwise known every bit TIME_SERIES_DAILY_ADJUSTED.

We need to figure out which function in the library corresponds with the API endpoint we are trying to call. We can practise that past running the assistance control.

aid(app)

This gives us a printout of all the different functions available within the TimeSeries class. They are in the same lodge every bit they appear in the documentation and so it should exist like shooting fish in a barrel to find the correct i.

The paradigm above shows the function we are afterward. As yous can see, the just parameter we demand to laissez passer through is the stock ticker symbol.

Past default, the library will set the output size to meaty. This will return the last 100 data points. If you are looking to for more data and then merely pass through output='full' to go all the data available.

from alpha_vantage.timeseries import TimeSeries app = TimeSeries() #aid(app) aapl = app.get_daily_adjusted('AAPL', outputsize='full') impress(appl) And there y'all have it, the last 100 daily data points for AAPL in iv lines of code.

The return output by default is in JSON. Further in the tutorial, we will discuss outputting data in CSV and in pandas.

How tin can I get remember stock data without using the Blastoff Vantage library in Python?

We can get the same data in the above example without using the Alpha Vantage library fairly easily. In that location are numerous libraries available to access URLs. Normally known libraries include http.customer, requests, and urllib just to name a few.

In our instance, we will use the requests library. If you don't already have it installed, type in pip install requests to install it.

Our first step is to import the requests library and the os library. The latter will be used to retrieve our API key from the environment variable that we created.

import requests import bone api_key = os.getenv('ALPHAVANTAGE_API_KEY') print(api_key) The above code will print out your API primal, just to make certain everything is working. If you lot don't take your key saved every bit an surround variable, yous can assign your key to the api_key variable at this point.

You may have noticed that the Alpha Vantage documentation has examples in each section. Allow's copy the start case URL in the documentation for TIME_SERIES_DAILY_ADJUSTED and create a request.

response = requests.get('https://www.alphavantage.co/query?part=TIME_SERIES_DAILY_ADJUSTED&symbol=IBM&apikey=demo') print(response.json()) In the above code, nosotros've passed in the entire URL right into the request. At that point, we used .json(), which is part of the requests library, to convert the JSON information to a Python dictionary.

As you can see, we can brand requests by just passing through our parameters into the URL.

We can even use an f string to make the parameters a chip more dynamic.

base_url = 'https://www.alphavantage.co/query?' function = 'TIME_SERIES_DAILY_ADJUSTED' symbol = 'IBM' response = requests.get(f'{base_url}function={function}&symbol={symbol}&apikey={api_key}') print(response.json()) The above code allows us to easily change the parameters by assigning different values for the associated variables.

Passing through the unabridged URL with parameters, or using f strings, will requite you the desired outcome. Withal, it's not a very Pythonic way of doing things. The code snippet beneath attempts to 'make clean things up a bit'.

base_url = 'https://world wide web.alphavantage.co/query?' params = {'function': 'TIME_SERIES_DAILY_ADJUSTED', 'symbol': 'IBM', 'apikey': api_key} response = requests.get(base_url, params=params) print(response.json()) What we've done hither is created a lexicon that holds all of our parameters. We then pass the dictionary into our request which is a much cleaner fashion of doing this. Specially for calls where several parameters are required. It too makes our code much more readable in instance we take to brand changes down the road.

At present that nosotros have our base lawmaking for making requests, you should exist able to query any of the Blastoff Vantage endpoints. Simply modify or append the params lexicon with the required API parameters listed within the documentation. The base URL will remain the same for all queries.

Does the Alpha Vantage API work well with the pandas library?

The pandas library is great for manipulating data and is popular among algo traders.

Integration with pandas is built into the Blastoff Vantage library. Simply pass through output_format='pandas' when instantiating the appropriate form for your request.

from alpha_vantage.foreignexchange import ForeignExchange app = ForeignExchange(output_format='pandas') eurusd = app.get_currency_exchange_intraday('EUR', 'USD') print(eurusd[0]) In the higher up example, we are requesting intraday data for EUR/USD. By default, the library returns 15 minute candles for this particular endpoint.

The returned data is a tuple that contains the pandas dataframe as well as data nigh the returned data. Since we're only interested in the dataframe, we've specified print(eurusd[0]) to separate the dataframe from the tuple.

What's great about the dataframe returned by the library is that it is formated with a time-series index. That means we can run commands like this:

print(eurusd[0]['2020-04-01'])

This allows us to narrow downwardly our dataframe to simply candles from Apr 1st.

Below is the code to perform the same function without using the library.

import os import requests import pandas every bit pd api_key = os.getenv('ALPHAVANTAGE_API_KEY') base_url = 'https://www.alphavantage.co/query?' params = {'function': 'FX_INTRADAY', 'from_symbol': 'EUR', 'to_symbol': 'USD', 'interval': '15min', 'apikey': api_key} response = requests.get(base_url, params=params) response_dict = response.json() _, header = response.json() #Convert to pandas dataframe df = pd.DataFrame.from_dict(response_dict[header], orient='index') #Clean up column names df_cols = [i.split up(' ')[ane] for i in df.columns] df.columns = df_cols df.set_index('timestamp', inplace=True) #Time-series index print(df) Getting the response into a dataframe isn't straightforward only can be washed with a few tweaks.

First, we had to separate out our toll data from the JSON response as it contains two parts of information. The first office provides data about the query, or substantially, metadata. The second office is the price data that we are after. And so we've had to specify that nosotros only want to catechumen the time series information into a dataframe.

We were able to separate the 2 parts of the response with this control: _, header = response.json(). This is a dynamic method to obtain the dictionary primal value for the price data. We then use that data to convert our dictionary to a pandas dataframe.

We also had to add together orient='index'. Otherwise, the row and columns are inversed due to the nature of the response format.

Lastly, we've cleaned up the column headers only to remove any numbers or spaces and fix the timestamp column every bit the index to create a time-series index.

Should I use the CSV or JSON format for my information?

Choosing between CSV or JSON comes downwards to what you intend on doing with the data after the fact, and to a certain caste, personal preference.

The advantage of the CSV format is that it comes with little overhead. Unlike the JSON format, information technology does not accompany metadata. Further, the column headers are already neatly formatted.

The disadvantage of the CSV format is that it is not hands recognized past Python. Y'all may have noticed how easily the requests module is able to catechumen JSON objects to a dictionary in the previous examples.

You tin can use the CSV module which is a standard Python library, although we find that method to exist tiresome – once again personal preference.

If y'all're looking to salvage data for afterwards use, CSV is the manner to get. Cheque out the lawmaking snippet below:

import os import requests import pandas as pd api_key = os.getenv('ALPHAVANTAGE_API_KEY') base_url = 'https://www.alphavantage.co/query?' params = {'part': 'FX_INTRADAY', 'from_symbol': 'EUR', 'to_symbol': 'USD', 'interval': '15min', 'datatype': 'csv', 'apikey': api_key} response = requests.get(base_url, params=params) #Relieve CSV to file with open up('eurusd.csv', 'wb') as file: file.write(response.content) df = pd.read_csv('eurusd.csv') #Create pandas dataframe df.set_index('timestamp', inplace=True) #Fourth dimension-serial index Observe that we're able to get relieve the response as a file in two lines of codes. Further, once saved, we tin can recall the data straight into a pandas dataframe using only one line of lawmaking.

If y'all attempt to save the CSV response directly to a dataframe, you're likely to get an error unless you clean up the data first.

If you plan to use the Alpha Vantage library, your best bet is to utilise the pandas output format. If you demand to relieve your pandas dataframe to file, just apply the following syntax:

df.to_csv('filename.csv')

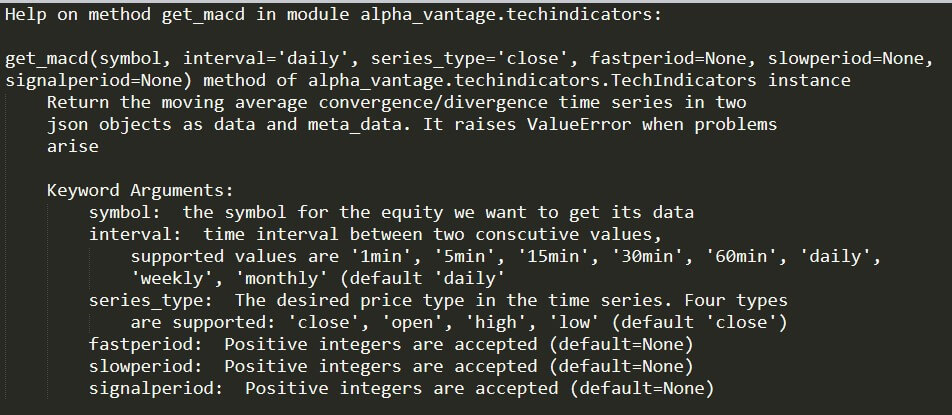

How can I use technical indicators with the Alpha Vantage library?

A great feature of the Alpha Vantage API is that it has values for over 50 different indicators. This saves having to manually summate them or employ a third-party library.

Let'south wait at an instance of getting MACD data for AAPL.

The Alpha Vantage library uses a standard naming convention in the TechIndicators class. Simply use get_ and add the name of the indicator equally information technology is stated in the documentation

help(app.get_macd)

Like to 1 of the prior examples, we can utilise the help function to find out the required arguments

Nosotros can see that we need to supply at least a symbol, the fast period, slow period, and signal period. The indicator will be calculated on the closing toll by default which is what we want. The interval is set up to daily by default.

from alpha_vantage.techindicators import TechIndicators app = TechIndicators(output_format='pandas') #help(app.get_macd) aapl_macd = app.get_macd('aapl', fastperiod=12, slowperiod=26, signalperiod=ix) impress(aapl_macd) In the code example higher up, we started by importing the TechIndicators class. We and then instantiated our class, specifying that the output should exist a pandas data frame. The required parameters were passed through the part and the output was saved as aapl_macd.

Y'all tin can apply the same format used in the code snippet above to get values for other indicators. A cool characteristic of time-series dataframes is that we can easily merge our indicator dataframe with a toll dataframe. Pandas will match upward merged dataframes with the index column which in our case is a timestamp.

Y'all may have noticed when we pulled Forex data that we had to separately specify the from currency and to currency. For technical indicators, the syntax differs in that the symbol is used as a whole. Take a look at the post-obit examples for Bitcoin and USD/JPY.

BTC_macd = app.get_macd('BTCUSD', fastperiod=12, slowperiod=26, signalperiod=9) usdjpy_macd = app.get_macd('USDJPY', fastperiod=12, slowperiod=26, signalperiod=nine) While this is a useful characteristic of the API, we recommend merely using information technology for historical data. If you attempt to employ it for realtime data, especially on smaller time frames, make sure not to go over your rate limit.

Final Thoughts

Alpha Vantage offers a peachy product, and best of all, the complimentary API has a very generous rate limit. The Alpha Vantage library makes the API easier to apply, especially if you plan to apply pandas.

If you intend to use the API as part of your automatic trading system we suggest you implement some grade of fault checking to confirm that your asking did in fact render valid data as internet interruptions do happen. Also, exist mindful of the 500 requests per day limit and brand sure your API key is kept secure.

Download Code

The code used in the examples is bachelor on GitHub. From the GitHub folio, click the greenish button on the right "Clone or download" to download or clone the lawmaking.

How To Use Alpha Vantage Api,

Source: https://algotrading101.com/learn/alpha-vantage-guide/

Posted by: moralesknoid1942.blogspot.com

0 Response to "How To Use Alpha Vantage Api"

Post a Comment